Business

Creating Your Corporate Logo

There are many reasons as to why one should create a logo. For some, it may be because they wanted to known for their business. While for others, they may want to known personally through a logo. Either way, creating a logo and designing it to your own style will give appreciation, familiarity and remembrance that a certain service, business or establishment is existing.

With the technology nowadays, through the use of social media, like Facebook, Instagram, Twitter and more, entrepreneurs and businessmen uses these modes of endorsement to reach out and boost their sales through social media advertising and for them to be remembered, they create, request or pay for their own logo.

Quality Design:

Logojoy makes it easy and fun for anyone to create a professional quality design. With the right quality of service they provide. It will seem like you are sitting beside the designer to experience the high-quality service they provide. Their objective is to empower everyone to get a professional quality design without a fuss and at the price, they can afford. This is designed for entrepreneurs who cares about their branding and familiarity.

Pricing depends on the package you will be getting. From the Basic package starting from $20.00 which includes: Low resolution logo with a colored background. Premium package with a price of $65.00 that provides High resolution PNG, Vector, EPS and SVG image files with a lifetime phone support that will assist you with your modification needs and lastly. The top of the line with a price starting from $165.00 where everything is virtual, the Premium Package. It includes One-hour design session with the designer, lifetime phone support and more.

There are many reasons as to why one should create a logo. For some, it may be because they wanted to known for their business. While for others, they may want to be known personally through a logo.

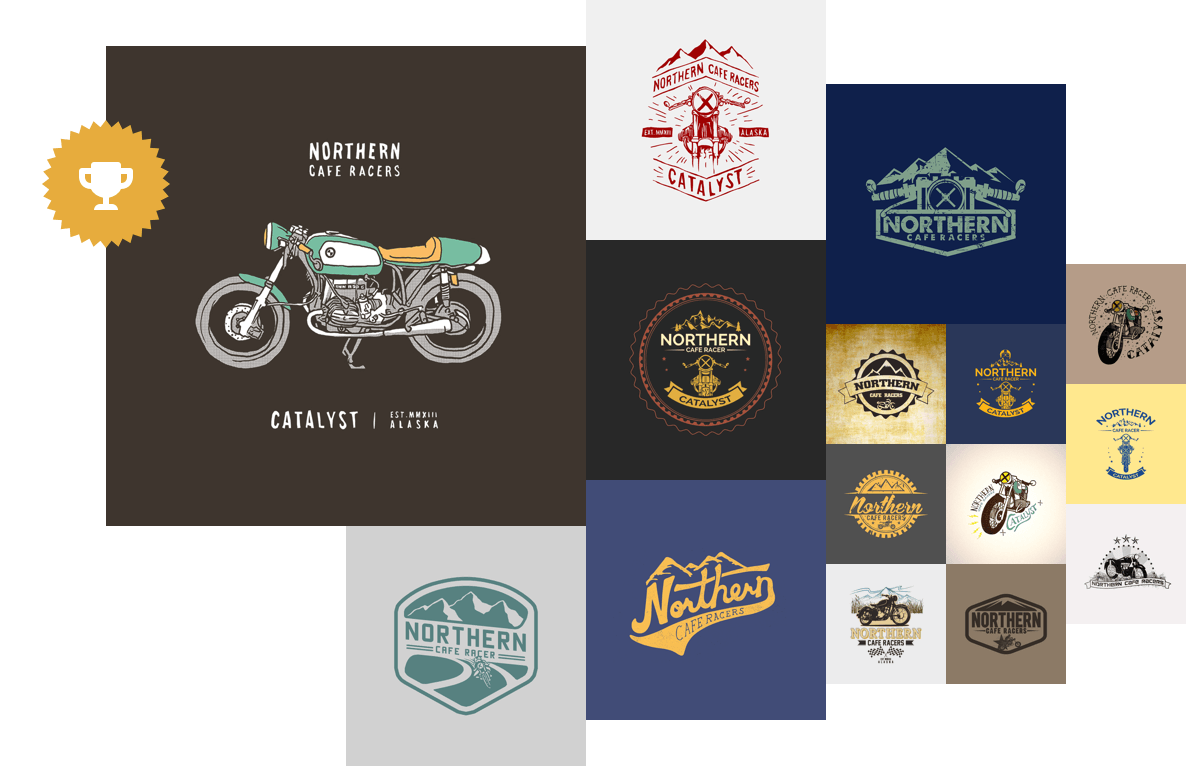

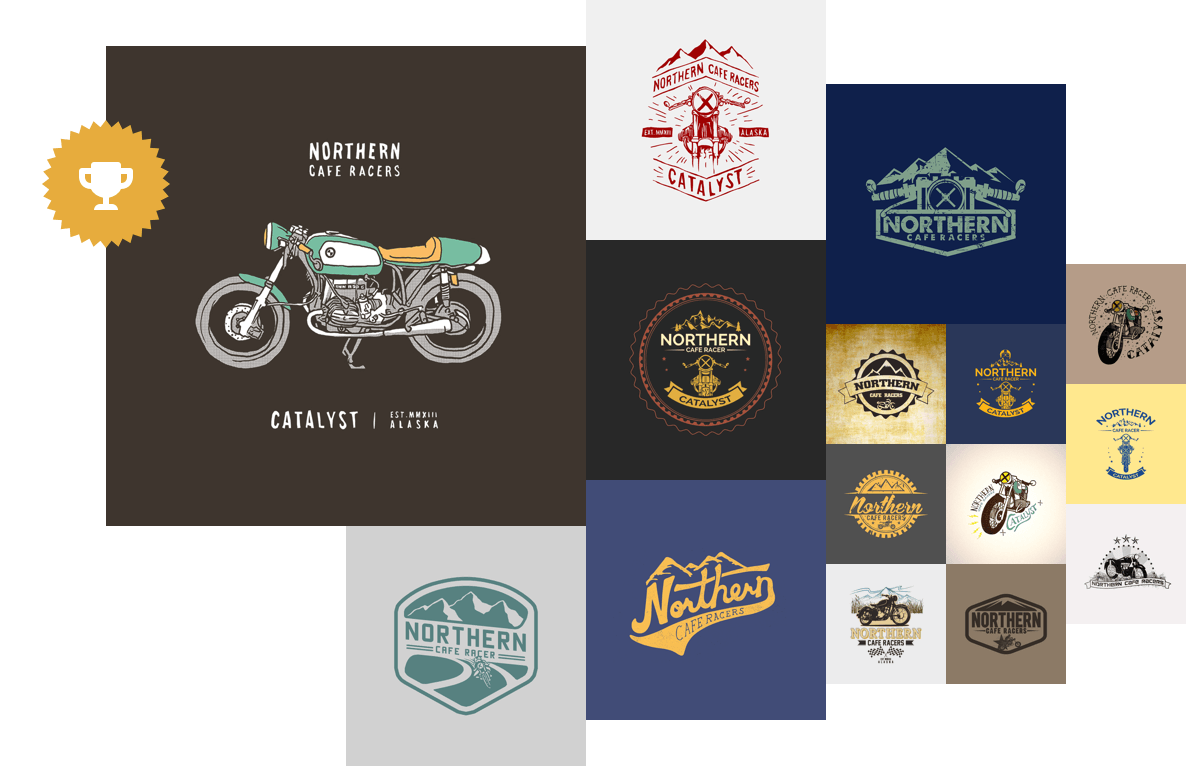

Creative Logo:

Either way, creating the logo and designing it to your own style will give appreciation, familiarity and remembrance that a certain service, business or establishment is existing.

With the technology nowadays, through the use of social media, like Facebook, Instagram, Twitter and more, entrepreneurs and businessmen use these modes of endorsement to reach out and boost their sales through social media advertising and for them to be remembered. They create, request or pay for their own logo.

There are websites and logo creator sites who provide free designing and creation of logos. But if you want a solid, detailed and keen creation of your logo. One perfect suggestion for a site to visit is Logojoy.

Logojoy makes it easy and fun for anyone to create the professional quality design. With the right quality of service they provide. It will seem like you are sitting beside the designer to experience the high-quality service they provide. Their objective is to empower everyone to get a professional quality design without a fuss and at the price they can afford. This is designed for entrepreneurs who cares about their branding and familiarity.

Technology4 weeks ago

Technology4 weeks ago10 Best Generative AI Tools to Scale Your Business in 2024

Games2 weeks ago

Games2 weeks agoA Brief History of Solitaire: From Cards to Computers

Model3 weeks ago

Model3 weeks agoKatelyn Ernst: Bio, Age, Lifestyle, Career, Hair & Eye Color, Net Worth

Technology2 weeks ago

Technology2 weeks agoHow To Enhance Your Learning With Duolingo Podcasts?

Technology5 days ago

Technology5 days agoThe Website Design Workshop: Crafting User-Centric Sites

Pingback: Importance of Logo for Business Branding